Top Reasons to Sue a Car Dealership Explained

If you’re considering suing a car dealership, there are several things to consider. Taking legal action may be necessary in certain circumstances to protect your rights as a consumer. In this article, we’ll discuss the top reasons to sue a car dealership to provide you with information for potential legal action.

Key Takeaways:

- Breach of contract is a common reason to sue a car dealership if they fail to fulfill the terms outlined in your contract.

- Negligence by a car dealership, such as causing damage or using defective parts, can be grounds for legal action.

- Fraud or deception, such as hiding damage, misrepresenting a car’s history, or false financing claims, can be legitimate reasons to sue.

- Consumer protection violations, where a dealership violates federal or state laws, may warrant legal action.

- Warranty issues, such as a dealership not honoring warranty terms, can be valid grounds for a lawsuit.

Breach of Contract

One of the most common reasons to sue a car dealership is a breach of contract. When you purchase a car from a dealership, you enter into a legally binding agreement. This agreement, known as a contract, outlines the terms and conditions that both you and the dealership must abide by. If the dealership fails to fulfill their end of the contract, you may have grounds to take legal action.

There are several ways in which a car dealership can breach a contract. One example is misrepresentation, where the dealership provides false information about the car’s condition, history, or pricing. Another example is the failure to disclose important information about the vehicle, such as previous accidents or mechanical issues.

Deceptive practices are also grounds for breach of contract. This could include the dealership making promises or guarantees that they do not fulfill, such as offering a warranty and then refusing to honor it. Similarly, if the dealership fails to deliver on any other promises made during the negotiation or purchase process, it can be considered a breach of contract.

If you believe that a car dealership has breached the contract, it’s important to gather evidence to support your claim. This can include copies of the contract, any documentation of misrepresentation or failure to disclose, and any communication with the dealership regarding the breach of contract.

Before filing a lawsuit for breach of contract against a car dealership, it’s advisable to consult with an attorney who specializes in contract law. They can assess the strength of your case, guide you through the legal process, and help you understand your rights and options.

Quote: “When a car dealership fails to fulfill the terms of a contract, it can leave consumers feeling frustrated and taken advantage of. By taking legal action for breach of contract, you have the opportunity to seek compensation for any damages you may have suffered as a result.” – Attorney Jane Smith

Examples of Breach of Contract by Car Dealerships

| Examples | Description |

|---|---|

| Misrepresentation | The dealership provides false information about the car’s history, condition, or pricing. |

| Failure to Disclose | The dealership fails to disclose important information about the vehicle, such as previous accidents or mechanical issues. |

| Deceptive Practices | The dealership makes promises or guarantees that they do not fulfill, such as offering a warranty and then refusing to honor it. |

Negligence

Negligence is another common reason to sue a car dealership. When a dealership fails to fulfill its duty of care and causes damage to your car, does not properly maintain or repair your vehicle, or uses defective parts, you may have a valid claim for negligence. Car dealerships have a responsibility to ensure the safety and reliability of the vehicles they sell, and any negligence on their part can result in significant financial and personal consequences for consumers.

Instances of negligence by car dealerships can include:

- Failure to properly inspect or disclose existing damage to a vehicle

- Improper or inadequate maintenance and repair work

- Using substandard or defective parts

If you believe that negligence by a car dealership has caused harm to you or your vehicle, it is important to document any evidence of the negligence and consult with a lawyer experienced in consumer protection and automotive law to determine the strength of your case. By taking legal action for negligence, you may be able to seek compensation for the damages caused and hold the dealership accountable for their actions.

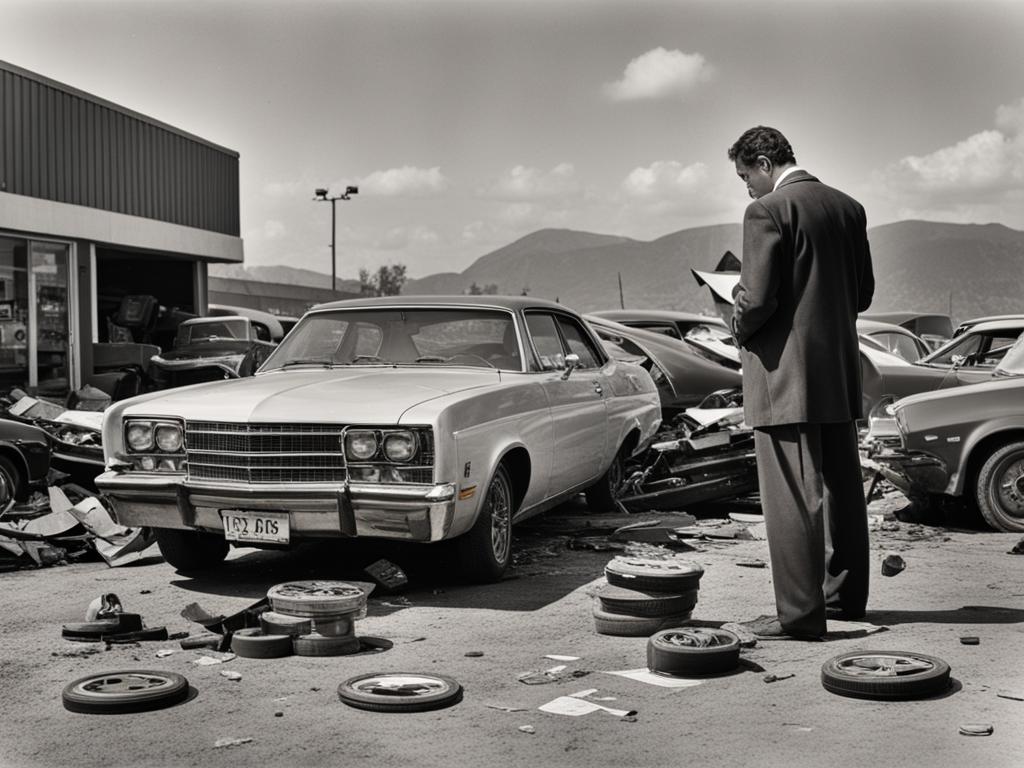

Case Study: Negligence Leads to Costly Repairs

“I purchased a used car from a reputable dealership, but within a week, it started experiencing mechanical issues. When I took it to a trusted mechanic, they discovered that the dealership had not disclosed significant damage to the suspension system, which led to extensive repairs. I filed a lawsuit against the dealership for negligence, and with the help of my lawyer, I was able to recover the cost of the repairs and hold the dealership accountable for their failure to disclose the damage.”

Fraud or Deception

If you suspect that a car dealership has engaged in fraudulent or deceptive practices, it’s crucial to understand your rights as a consumer. Fraud or deception can take various forms, such as the dealership hiding damage or defects in a used car, misrepresenting the vehicle’s history and condition, or making false claims about financing terms. These dishonest actions can leave unsuspecting buyers with significant financial and legal burdens.

If you find yourself in this situation, it may be necessary to take legal action to protect yourself and seek compensation for the harm caused. By filing a lawsuit against the car dealership for fraud or deception, you can hold them accountable for their actions and potentially recover damages.

When pursuing a legal case against a car dealership for fraud or deception, it’s essential to gather evidence that supports your claim. This can include any documentation, such as advertisements, contracts, emails, or receipts, that demonstrate the dealership’s fraudulent or deceptive practices.

Consulting with an attorney who specializes in consumer protection or automotive law can provide invaluable guidance throughout the legal process. They can review your case, advise you on the strength of your claim, and help you navigate the complexities of filing a lawsuit against a car dealership for fraud or deception.

In some instances, a class-action lawsuit may be an option if multiple consumers have been affected by the same fraudulent or deceptive practices. However, it’s crucial to consult with legal professionals to determine the viability and suitability of this course of action.

Quote:

“Fraud and deception by car dealerships can have severe consequences for consumers. It’s important to take legal action to protect your rights and seek the compensation you deserve.”

– John Smith, Consumer Rights Advocate

| Steps for Filing a Lawsuit Against a Car Dealership for Fraud or Deception |

|---|

| 1. Gather all relevant evidence, including contracts, advertisements, and correspondence. |

| 2. Consult with an attorney specializing in consumer protection or automotive law. |

| 3. Determine the strength of your claim and discuss potential legal strategies. |

| 4. File a complaint with regulatory agencies if applicable, such as the Federal Trade Commission or state consumer protection agencies. |

| 5. Initiate legal proceedings by filing a lawsuit against the car dealership. |

| 6. Adhere to the legal process, including attending hearings, providing evidence, and possibly participating in settlement negotiations. |

| 7. Work closely with your attorney to build a strong case and pursue a favorable outcome. |

Keep in mind that the legal process can be complex and time-consuming. It’s essential to have realistic expectations and seek professional guidance to ensure you fully understand the potential outcomes and risks involved in suing a car dealership for fraud or deception.

Consumer Protection Violations

When purchasing a car from a dealership, you have the right to expect fair and honest business practices. However, some car dealerships may engage in consumer protection violations, which can leave you feeling cheated or deceived. Understanding your rights and the legal recourse available to you is crucial in such situations.

Consumer protection laws exist both at the federal and state levels to safeguard consumers against unfair and deceptive practices. These laws are designed to hold businesses accountable for their actions and provide consumers with the means to seek justice.

Consumer protection violation cases can arise from various deceptive practices employed by car dealerships. Some common examples include:

- False advertising: Dealerships may advertise misleading prices or financing terms to attract customers.

- Bait and switch tactics: Dealerships may lure customers with one car model but then pressure them into purchasing a more expensive model.

- Non-disclosure of damage or defects: Some dealerships fail to disclose known issues or previous damage to a vehicle, leaving the buyer with unexpected repairs or safety concerns.

- Hidden fees: Some dealerships may add undisclosed fees or charges to the final price of the vehicle.

- Unfair financing practices: Dealerships may manipulate interest rates or misrepresent the terms of a financing agreement.

If you believe that a car dealership has violated your consumer rights, you have the option to take legal action. Suing a car dealership for consumer protection violations can help you seek compensation for any losses or damages you have incurred.

“Consumer protection laws exist to ensure that businesses engage in fair and transparent practices. If a car dealership violates these laws, consumers have the right to hold them accountable.”

Before proceeding with legal action, it’s important to gather evidence to support your claim. This may include any contracts, receipts, or other documentation related to your purchase. Consulting with an experienced attorney who specializes in consumer protection can also provide valuable guidance and support throughout the process.

Civil litigation for consumer protection violations can result in various outcomes, including financial compensation, injunctions to stop the deceptive practices, or even punitive damages to deter future misconduct by the dealership.

Remember, the decision to file a lawsuit against a car dealership should be carefully considered based on the circumstances. It’s crucial to determine the strength of your case, the potential costs involved, and the likelihood of a favorable outcome.

| Benefits of Suing a Car Dealership for Consumer Protection Violations | Things to Consider Before Filing a Lawsuit |

|---|---|

|

|

Warranty Issues

When purchasing a vehicle, one of the factors that provide peace of mind is the warranty. A warranty ensures that if any issues arise with your vehicle within a specific period, the dealership will cover the necessary repairs or replacements. However, warranty issues can occur, leaving consumers frustrated and out of pocket. If you find yourself facing warranty problems, you may have grounds to sue the car dealership and seek compensation for your expenses.

When it comes to warranty issues, the key concern is when a vehicle that is supposed to be under warranty doesn’t function properly, resulting in costly repairs that the dealership refuses to cover. This situation can leave you feeling deceived and cheated, but there are legal avenues available to address such matters.

Understanding Your Rights

It’s crucial to understand your rights as a consumer when it comes to warranty issues and the potential for legal action. When you purchase a vehicle with a warranty, you enter into a contract with the dealership, which means they have an obligation to honor the terms of the warranty agreement. If they fail to fulfill their responsibilities, you may have grounds to sue for breach of contract.

It’s also important to review the warranty agreement to ensure that the issues you’re facing are covered. If the dealership refuses to address the problems despite them being within the warranty’s scope, this can be considered a violation of your consumer rights.

Gathering Evidence

When preparing to file a lawsuit against a car dealership for warranty issues, it’s crucial to gather evidence to support your claim. This evidence may include written correspondence with the dealership, records of repairs and expenses, and any other relevant documentation that proves the dealership’s failure to honor the warranty. These pieces of evidence will be essential in building a strong case and increasing the chances of a favorable outcome.

| Important Evidence to Collect for Your Case | Why It’s Important |

|---|---|

| Correspondence with the dealership | Shows attempts to resolve the issue amicably |

| Repair records and receipts | Documents the expenses incurred and the dealership’s refusal to cover them |

| Warranty agreement | Verifies the terms and conditions of the warranty |

| Expert opinions | Provides professional assessments supporting your claim |

An experienced attorney can guide you in collecting the necessary evidence and building a strong case against the car dealership.

Filing a Lawsuit

Before filing a lawsuit against a car dealership for warranty issues, it’s advisable to consult with a qualified attorney who specializes in consumer protection and contract law. They can evaluate the merits of your case, guide you through the legal process, and help you understand your rights and options.

Typically, filing a lawsuit involves drafting a complaint, gathering and submitting evidence, and presenting your case in court. Your attorney will guide you through each step, ensuring that your rights are protected and presenting the strongest possible case to seek compensation for your warranty issues.

In conclusion, warranty issues can be a frustrating experience for car owners. However, you have legal recourse to address these problems and seek compensation from the car dealership. By understanding your rights, gathering evidence, and seeking legal guidance, you can increase your chances of receiving the compensation you deserve for the financial burden caused by warranty issues.

Failure to Disclose

If you’re considering suing a car dealership, one common reason for legal action is the failure to disclose important information. This occurs when the dealership deliberately misleads buyers in order to induce a purchase based on false promises or fails to disclose a known defect. In such cases, you may have a valid claim for failure to disclose and seek compensation through a lawsuit.

When a car dealership fails to disclose vital information about a vehicle, it can have serious consequences for the buyer. For example, if the dealership hides prior damage, conceals the car’s accident history, or neglects to mention mechanical issues, it can lead to significant financial burdens or safety concerns for the buyer.

It’s important to note that failure to disclose can encompass various aspects of a car’s condition, history, or financing terms. Whether it’s the presence of structural damage, a salvaged title, a significant accident, liens on the vehicle, or hidden fees, the failure to disclose exposes the buyer to unexpected risks and costs.

In situations where a car dealership engages in misleading practices or omits critical information, legal action may be necessary to protect your rights as a consumer. By filing a lawsuit for failure to disclose, you can seek compensation for any financial losses, repairs, or other damages incurred due to the dealership’s deceptive actions.

“The failure to disclose important information can have serious consequences for car buyers, leading to financial burdens and safety concerns.”

If you believe that a car dealership has failed to disclose critical information during the buying process, it’s essential to gather evidence to support your claim. This evidence may include any documents, communications, or witness testimonies that prove the dealership’s deliberate intent to mislead or withhold information.

Consulting with an experienced lawyer specializing in consumer protection can help you understand your legal rights and navigate the complex process of filing a lawsuit against a car dealership for failure to disclose. A lawyer can guide you through the necessary steps, provide legal advice, and represent your interests in seeking fair compensation.

Example: Failure to Disclose Lawsuit

John Smith recently purchased a used car from ABC Car Dealership. During the sales process, the dealership assured John that the car had no history of accidents or mechanical issues. However, shortly after the purchase, John discovered that the car had been involved in a serious collision, resulting in hidden structural damage and ongoing mechanical problems.

Feeling deceived by the dealership’s failure to disclose this vital information, John decided to take legal action. He consulted with a knowledgeable attorney, who helped him gather evidence, such as expert assessments and repair records, to support his claim against the dealership.

With the assistance of his lawyer, John filed a lawsuit against ABC Car Dealership for failure to disclose the car’s accident history and concealed damages. By seeking legal recourse, John aimed to recover the cost of repairs and any other financial losses caused by the dealership’s deceptive practices.

Steps to Pursue a Lawsuit for Failure to Disclose

| Steps | Description |

|---|---|

| 1 | Gather evidence of the dealership’s failure to disclose |

| 2 | Consult with an attorney specializing in consumer protection |

| 3 | Initiate legal proceedings by filing a complaint |

| 4 | Present evidence during the litigation process |

| 5 | Attend mediation or settlement negotiations, if applicable |

| 6 | Proceed to trial, if an agreement cannot be reached |

| 7 | Pursue fair compensation for financial losses and damages |

Return Refusal

If you find yourself in a situation where you want to return a vehicle to a car dealership but they refuse to accept it, you may have grounds for legal action. A return refusal occurs when a dealership denies your request for a return, even if you were promised a “no questions asked” return policy or a “cooling off” period. This can be a frustrating experience, but knowing your rights and options can help you navigate the situation effectively.

When a car dealership refuses to take back a vehicle, it can leave you feeling trapped with a car you no longer want or need. This can happen for various reasons, such as the dealership claiming that the return period has expired, disputing the condition of the vehicle, or asserting that they do not offer returns on used cars. Regardless of the reason, if you were given explicit assurances of a return policy, you may have legitimate grounds to pursue legal action.

It’s important to gather any evidence that supports your claim, such as documentation of the return policy, receipts, and correspondence with the dealership. This evidence can strengthen your case and help support your arguments in court.

When faced with a return refusal, it’s advisable to consult with an attorney who specializes in consumer protection or contract law. They can assess the details of your case, determine the strength of your potential claim, and guide you through the legal process.

Steps to Take When Faced with Return Refusal:

- Contact the dealership in writing: Write a formal letter or email to the dealership outlining your concerns and referencing the promised return policy. Keep a copy of this correspondence for your records.

- Research state consumer protection laws: Familiarize yourself with the consumer protection laws in your state to understand your rights and the obligations of the dealership.

- Consult with an attorney: Seek legal advice from a knowledgeable attorney who can evaluate your case and provide guidance on the best course of action.

- File a complaint with relevant authorities: If necessary, file a complaint with the appropriate consumer protection agency or the Better Business Bureau to bring attention to the dealership’s refusal to accept a return.

- Consider alternative dispute resolution methods: In some cases, mediation or arbitration may be viable options to resolve the dispute without going to court. An attorney can help you explore these alternatives.

- Initiate a lawsuit if necessary: If all other options fail, you may need to file a lawsuit against the car dealership to seek the return of your money or the acceptance of the vehicle’s return.

Remember that the legal process can be complex and time-consuming. It’s crucial to have a strong case and sufficient evidence to support your claims. Consulting with an attorney will provide you with clarity and help you make informed decisions about pursuing legal action.

Steps to Take in a Dispute with a Car Dealership

If you find yourself in a dispute with a car dealership, it’s important to take certain steps to try and resolve the issue. Following these steps can help you navigate the process and increase your chances of a satisfactory resolution.

Gather Relevant Documents

Before proceeding with any action, gather all relevant documents related to the dispute. This may include the sales contract, warranty information, service records, and any correspondence exchanged with the dealership. Having these documents readily available will help you present a strong case in your favor.

Try to Resolve the Issue Directly with the Dealership

Begin by attempting to resolve the dispute directly with the dealership. Contact their customer service department or speak to a manager to explain the problem and request a resolution. Clearly communicate your concerns, and provide any evidence or supporting documents you have gathered. Be prepared to negotiate and find a mutually acceptable solution.

Seek the Advice of a Lawyer

If your attempts to resolve the dispute directly with the dealership are unsuccessful, it may be time to seek legal advice. Consult with an experienced lawyer who specializes in consumer protection or contract law. They can provide guidance on your rights, assess the strength of your case, and advise you on the best course of action to take.

File a Complaint with a Government Agency

If all else fails, consider filing a complaint with a relevant government agency. This could be a local consumer protection agency, the Better Business Bureau, or the Attorney General’s office in your state. These agencies may be able to mediate between you and the dealership or take further action to address your complaint.

Remember, it’s important to act promptly when in a dispute with a car dealership. Understand your rights, gather evidence, and exhaust all possible avenues for resolution before considering legal action. Taking these steps can help protect your interests and increase the likelihood of a satisfactory outcome.

| Steps in a Dispute with a Car Dealership |

|---|

| Gather Relevant Documents |

| Try to Resolve the Issue Directly with the Dealership |

| Seek the Advice of a Lawyer |

| File a Complaint with a Government Agency |

Important Considerations Before Suing Car Dealerships

Before deciding to sue a car dealership, it’s essential to take several considerations into account. Taking legal action should be a well-thought-out decision, as it can be a complex and time-consuming process. Here are a few important factors to keep in mind:

1. Explore Other Options

Before resorting to a lawsuit, consider trying to resolve the issue directly with the dealership. Engaging in open communication and discussing the problem may lead to a mutually agreeable solution. In some cases, car dealerships may be willing to rectify the situation or compensate you for any damages or inconveniences.

2. Seek Legal Advice

If your attempts to resolve the issue directly with the dealership are unsuccessful or if the situation involves complex legal matters, it’s advisable to seek the guidance of a lawyer specializing in consumer rights and automotive law. A lawyer can provide valuable insights into the strength of your case, the legal options available to you, and the potential outcomes of proceeding with a lawsuit.

3. Understand the Legal Process

When considering legal action against a car dealership, it’s crucial to have a realistic understanding of the legal process. Lawsuits can be lengthy and require substantial time and effort to gather evidence, respond to legal requests, and attend court hearings. Familiarize yourself with the steps involved in a lawsuit, including filing a complaint, discovery, negotiation, and potential settlement or trial.

4. Gather Relevant Evidence and Documentation

A strong case requires solid evidence. Collect and organize all relevant documentation related to your dispute with the car dealership, such as sales contracts, repair records, correspondence, and receipts. This evidence will support your claims and help establish the dealership’s wrongdoing or negligence, strengthening your position in a potential lawsuit.

5. Assess the Potential Costs and Benefits

Consider the financial implications of pursuing legal action against a car dealership. Lawsuits can involve expenses such as attorney fees, court filing fees, and expert witness fees. Evaluate the potential financial recovery or compensation you might receive if successful in your lawsuit, and compare it to the costs involved. Understanding the potential benefits and costs will help you make an informed decision.

6. Evaluate the Strength of Your Case

Assess the merits of your case with your legal counsel. Consider the evidence, applicable laws, and legal precedents that support your claims. Your lawyer can help determine the likelihood of success and advise you on the best course of action based on their expertise and experience in similar cases.

By carefully considering these important factors, you can make an informed decision about whether to pursue legal action against a car dealership. Remember, each situation is unique, so it’s essential to seek personalized legal advice based on your specific circumstances.

Introduction to Shady Practices by Car Dealerships

Car dealerships have long been associated with shady practices that consumers have complained about. These practices can be legitimate reasons to sue a car dealership and include issues such as paying more than the advertised price, buying a car that breaks down immediately, or the dealer not honoring warranties.

Shady practices by car dealerships can leave consumers feeling deceived, frustrated, and financially burdened. Whether it’s the result of misleading sales tactics, false advertising, or poor quality vehicles, the consequences can be significant. In some cases, taking legal action may be the only way to hold car dealerships accountable for their shady practices and seek compensation for damages.

When dealing with shady practices by car dealerships, it’s important to understand your rights as a consumer and the legal options available to you. If you believe you have been a victim of deceitful or unfair practices, you may be able to sue the car dealership to seek justice and protect your interests.

Some common examples of shady practices by car dealerships include:

- Overcharging customers beyond the advertised price

- Selling vehicles with undisclosed mechanical issues

- Offering false promises or guarantees

- Misrepresenting the condition or history of a car

- Unfair financing terms or hidden fees

These practices can have serious financial and emotional consequences for consumers. If you have experienced any of these shady practices, it’s crucial to gather evidence and consult with an attorney who specializes in consumer protection laws. They can guide you through the legal process and help you determine if you have a valid claim against the car dealership.

Protecting Your Rights as a Consumer

Consumer protection laws are in place to safeguard the rights of consumers and hold businesses accountable for any illegal or unethical behaviors. When it comes to dealing with shady practices by car dealerships, familiarizing yourself with these laws can empower you to take legal action if necessary.

By understanding your rights as a consumer and the potential legal remedies available, you can navigate through the complexities of suing a car dealership for shady practices. Consulting with an attorney is vital to assess the viability of your case and develop a strong legal strategy.

| Steps to Take in Suing a Car Dealership for Shady Practices | Benefits of Taking Legal Action |

|---|---|

| 1. Collect all relevant documentation, including sales contracts, repair invoices, and any written communication with the dealership. | – Hold car dealerships accountable for their actions |

| 2. Consult with an attorney specializing in consumer protection laws to evaluate the strength of your case and discuss potential legal avenues. | – Seek compensation for financial losses |

| 3. File a lawsuit against the car dealership, outlining the specific shady practices you believe have occurred. | – Deter car dealerships from engaging in future shady practices |

| 4. Engage in negotiations or mediation to reach a settlement, if possible, or proceed to trial if a fair resolution cannot be reached. | – Protect the rights of other consumers by setting legal precedents |

Fighting against shady practices by car dealerships is not only about seeking justice for yourself but also about holding these businesses accountable to prevent them from taking advantage of others. By pursuing legal action, you can help protect the rights of other consumers and ensure a fair and transparent marketplace for all.

Warranty Issues as a Reason to Sue

When purchasing a car, one of the key factors that buyers consider is the warranty. A warranty provides a sense of security, assuring the buyer that if anything goes wrong with the vehicle, the dealership will take care of the repairs or replacements. Unfortunately, warranty issues can arise, leaving car owners frustrated and out-of-pocket. In some cases, warranty issues can be severe enough to warrant legal action against the car dealership.

If you find yourself facing warranty issues with your car dealership, you may have grounds to sue. There are several scenarios in which suing a car dealership for warranty issues can be justified:

- The dealership fails to honor the warranty: If you were led to believe that your car had a warranty, but the dealership refuses to honor it when you need repairs or replacements, you have a valid reason to take legal action.

- Costly repairs despite the warranty: If you end up paying for expensive repairs on your vehicle that should have been covered by the warranty, you may be entitled to compensation. This could include situations where the dealership denies the warranty claim without proper justification.

- Misrepresentation of warranty terms: If the dealership intentionally misrepresents the terms of the warranty, giving false assurances about coverage or duration, you may have grounds for a lawsuit. Car dealerships have a legal obligation to provide accurate information regarding warranties.

Suing a car dealership for warranty issues requires a thorough understanding of your rights as a consumer and the legal process involved. Consulting with an experienced attorney specializing in consumer law can provide you with valuable guidance and increase your chances of a successful lawsuit.

It’s important to note that each case is unique, and the specific circumstances surrounding the warranty issues will determine the outcomes of any legal action. Seek legal advice to evaluate the strength of your case and explore the available options for pursuing a lawsuit against the car dealership.

To illustrate the severity of warranty issues and the potential consequences for car owners, refer to the following table:

| Warranty Issue | Consequences |

|---|---|

| Denied warranty claim without valid reason | Financial burden on the car owner who has to cover expensive repairs |

| Dealership refuses to honor the warranty | Loss of trust in the dealership and potential financial losses for the car owner |

| Misrepresentation of warranty terms | Deception by the dealership and potential financial harm to the car owner |

Note: The consequences listed in the table above are general examples and may vary depending on the specific circumstances of each case.

When faced with warranty issues, it’s crucial to gather all relevant documentation, including the warranty agreement, repair invoices, and any communication with the dealership. This documentation will strengthen your case and provide evidence supporting your claims.

This section has highlighted warranty issues as a significant reason to sue a car dealership. If you find yourself facing warranty problems, it is important to seek legal advice to understand your rights and options for pursuing legal action against the dealership.

Breach of Contract as a Reason to Sue

If a car dealership breaches a contract, such as by not following the agreed-upon terms and conditions, you may have grounds to sue. This could include situations where the dealer misrepresents the price, breaks up the down payment, or fails to disclose important information about the car’s condition.

A breach of contract occurs when one party fails to fulfill their obligations as outlined in a legally binding agreement. In the context of purchasing a car from a dealership, this could involve various aspects of the transaction, such as the price, financing terms, warranties, or any other terms explicitly stated in the contract.

For example, if the dealership advertises a specific price for a car but then demands a higher price at the time of purchase, they have breached the contract. Similarly, if the dealership splits the down payment into multiple installments without your consent or fails to disclose significant damage or mechanical issues with the car, they may also be in breach of contract.

When dealing with a breach of contract by a car dealership, it’s important to gather evidence to support your claims. This can include documents such as the purchase agreement, financing statements, advertisements, or any correspondence with the dealership. Keeping a record of conversations, dates, and times can also strengthen your case.

If you believe that a car dealership has breached the contract, it’s advisable to consult with an attorney specializing in contract law. They can help evaluate the strength of your case, guide you through the legal process, and advise you on the appropriate steps to take to seek compensation for any damages incurred.

“A breach of contract by a car dealership can disrupt your plans and lead to financial loss. It’s important to protect your rights as a consumer and take legal action if necessary.”

Examples of Breach of Contract by a Car Dealership

| Situation | Breach of Contract |

|---|---|

| Car dealership advertises a car at a specific price but demands a higher price at the time of purchase | Failure to fulfill terms regarding the price |

| Dealer splits the down payment into multiple installments without consent | Failure to follow agreed-upon payment terms |

| Dealership fails to disclose significant damage or mechanical issues with the car | Failure to disclose important information about the car’s condition |

Fraudulent Behavior and Legal Action

If a car dealership engages in fraudulent behavior, such as changing the odometer or misrepresenting optional features, you may have grounds for legal action. It’s important to gather evidence and consult with a lawyer to determine the viability of a lawsuit.

Car dealerships that resort to fraudulent tactics not only betray consumer trust but also violate legal and ethical standards. If you suspect fraudulent behavior, it’s crucial to take appropriate steps to protect your rights and seek the justice you deserve. By collecting evidence, documenting communication, and seeking legal counsel, you can build a strong case against the dealership.

One instance of fraudulent behavior commonly encountered in car dealerships involves the manipulation of odometers. Dishonest dealers may roll back the mileage on used cars to make them appear more desirable and valuable. This deceptive practice is illegal and can lead to significant financial losses for unsuspecting buyers. By pursuing legal action against the dealership, you can hold them accountable for their fraudulent behavior and seek compensation for any damages incurred.

Another example of fraudulent behavior is the misrepresentation of optional features. Some dealerships may advertise additional features or accessories that are not actually included in the vehicle. This false advertising aims to attract potential customers and inflate the perceived value of the car. If you have been misled by such deceptive practices, you may have grounds for legal action.

When faced with fraudulent behavior by a car dealership, it’s essential to gather evidence to support your claims. This can include invoices, contracts, photographs, emails, or other documentation that proves the dealership’s deceptive practices. Consulting with a lawyer specialized in consumer protection or automotive law can offer invaluable guidance and help you navigate the legal process.

Taking legal action against a car dealership for fraudulent behavior sends a clear message that such practices will not be tolerated. By pursuing a lawsuit, you not only seek compensation for any financial losses but also contribute to protecting other consumers from falling victim to similar fraudulent schemes. Your legal action can have a significant impact on the dealership’s reputation and may result in changes to their business practices.

Steps to Take in a Lawsuit against a Car Dealership for Fraudulent Behavior

| Step | Description |

|---|---|

| 1 | Gather evidence |

| 2 | Consult with a lawyer |

| 3 | File a complaint with relevant authorities |

| 4 | Prepare your case |

| 5 | Initiate legal proceedings |

| 6 | Present evidence and arguments |

| 7 | Attend court hearings |

| 8 | Reach a settlement or await a judgment |

Conclusion

Deciding to sue a car dealership is a serious matter that requires careful consideration. Before taking legal action, it’s important to evaluate your individual circumstances and assess the potential outcomes. Consulting with a lawyer who specializes in consumer protection law can provide valuable guidance and help you understand the legal options available to you.

When weighing the decision to sue, it’s essential to consider alternative dispute resolution methods. Mediation or arbitration may offer a quicker and less adversarial way to resolve issues with the car dealership. These methods can save time, money, and emotional stress compared to going to court.

Seeking legal action against a car dealership should be approached with caution. While there are valid reasons to sue, it’s crucial to have solid evidence to support your claims. Documenting any breaches of contract, fraud, negligence, or consumer protection violations is essential to strengthen your case. Additionally, keeping a record of all communication with the dealership can provide valuable information and support your position.

Remember that every case is unique, and the decision to sue should be based on your specific circumstances. By considering the pros and cons, exploring alternative solutions, and seeking legal advice, you can make an informed choice about seeking legal action against a car dealership.

FAQ

What are the top reasons to sue a car dealership?

The top reasons to sue a car dealership include breach of contract, negligence, fraud or deception, consumer protection violations, warranty issues, failure to disclose, and return refusal.

When can I sue a car dealership for breach of contract?

You can sue a car dealership for breach of contract if they fail to fulfill the terms outlined in your contract, such as misrepresentation, failure to disclose important information, deceptive practices, or unfulfilled promises regarding your new car.

What constitutes negligence by a car dealership?

Negligence by a car dealership may include causing damage to your car, inadequate maintenance or repairs, or the use of defective parts.

How can I sue a car dealership for fraud or deception?

You can sue a car dealership for fraud or deception if they engage in practices such as hiding vehicle damage or defects, misrepresenting the car’s history and condition, or making false claims about financing terms.

What are consumer protection violations by a car dealership?

Consumer protection violations by a car dealership occur when they violate federal or state consumer protection laws intended to protect consumers from deceptive business practices.

Can I sue a car dealership for warranty issues?

Yes, you may have grounds to sue a car dealership for warranty issues if you purchased a vehicle that is under warranty but doesn’t function properly and you end up spending a significant amount of money on repairs.

When can I sue a car dealership for failure to disclose?

You can sue a car dealership for failure to disclose if they deliberately mislead buyers to induce a purchase based on false promises or fail to disclose a known defect in the vehicle.

Can I sue a car dealership for refusing a return?

Yes, if a car dealership refuses to accept a return when you were guaranteed a “no questions asked” return or a “cooling off” period, you may have grounds to sue for return refusal.

What steps can I take in a dispute with a car dealership?

Steps you can take in a dispute with a car dealership include gathering relevant documents, trying to resolve the issue directly with the dealership, seeking the advice of a lawyer, and filing a complaint with a government agency if necessary.

What considerations should I keep in mind before suing a car dealership?

Before suing a car dealership, it’s important to consider all options, including trying to resolve the issue directly or seeking legal advice. You should also be aware of the complexity and lengthiness of the legal process and the need for relevant evidence and documentation.

What are the shady practices by car dealerships?

Shady practices by car dealerships include issues such as paying more than the advertised price, buying a car that breaks down immediately, or the dealer not honoring warranties.

Are warranty issues a valid reason to sue a car dealership?

Yes, warranty issues can be a significant reason to sue a car dealership, especially if you were led to believe that your car had a warranty but it wasn’t honored, or if you ended up paying for costly repairs that should have been covered by the warranty.

When can I sue a car dealership for breach of contract?

You can sue a car dealership for breach of contract when they fail to follow the agreed-upon terms and conditions, such as misrepresenting the price, breaking up the down payment, or failing to disclose important information about the car’s condition.

What constitutes fraudulent behavior by a car dealership?

Fraudulent behavior by a car dealership can include activities like changing the odometer or misrepresenting optional features. To determine the viability of a lawsuit, it’s important to gather evidence and consult with a lawyer.

What should I consider before deciding to sue a car dealership?

Deciding to sue a car dealership is a personal decision that should be based on your individual circumstances. It’s important to weigh the pros and cons, consider alternative dispute resolution methods, and seek legal advice before taking any legal action.